Do you ever feel like you’re chasing the market? Why does everyone seem to arrive right on time while you’re always just one step behind? If you’re nodding along, takoz reep might be the missing link in your trading approach.

This guide covers everything from the basics of takoz reep to real-world strategies you can start using today. We’ll walk through examples, practical tips, and straightforward tactics to help you spot takoz reep patterns as a potential advantage in your trading strategy.

Whether you’re new to the concept or looking to deepen your understanding, this guide shows you how takoz reep can add a new dimension to your trading, helping you stay ahead and make more confident decisions in a fast-moving market.

Let’s get started.

Wedge Pattern: High-Probability Trading Tool for Market Breakouts

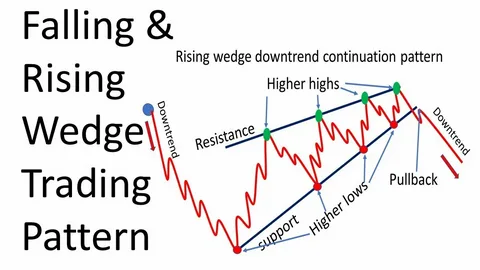

The wedge pattern, often recognized as a triangle formation in technical analysis, signals potential market breakouts by compressing price action into a tighter range. This “price squeeze” indicates that the market is building momentum, preparing for a strong move either upward or downward. Traders use wedge patterns to spot high-probability trades in stocks, crypto, and forex markets, as these setups often precede significant shifts in market direction. While not a foolproof strategy, the wedge pattern is a valuable tool that, when used effectively, helps traders capture timely opportunities for profit, making it essential in a pro trader’s toolkit.

Types of Takoz Reep Patterns: Rising and Falling Wedges

Let’s dive into the types of takes reep patterns you’ll encounter.

These are the bread and butter of this strategy.

-

Rising Wedge (Bearish Sign)

A rising wedge pattern takes shape when the price consistently makes higher highs and higher lows yet within a narrowing, converging range. This gradual squeeze often signals that buying momentum is slowing down, creating a potential setup for a bearish reversal. As the range tightens, it suggests that the price is struggling to maintain its upward momentum, increasing the likelihood of a downward breakout once sellers regain control. Traders often view the rising wedge as a warning of potential downside movement, making it a valuable signal to watch when preparing for possible trend reversals.

Imagine the price climbing up a staircase.

Each step gets narrower, making it harder for the price to keep going up. Eventually, it breaks down.

When to Spot It

Look for this pattern during an uptrend when prices have been rising.

Volume may decrease as the pattern tightens, signalling that the momentum is slowing.

Practical Example

Suppose you’re trading stocks, and the price has been trending up steadily. Suddenly, you spot the highs and lows getting closer.

This could be the beginning of a rising wedge—watch for that breakout to the downside.

-

Falling Wedge (Bullish Sign)

In contrast, a falling wedge occurs when the price makes lower highs and lower lows.

This one’s often bullish, signalling that the price may break out upward.

Picture the price movement getting squeezed down to a point, but buyers start stepping in, ready to push it up once it breaks.

When to Spot It

The falling wedge is usually found during a downtrend. It suggests that the bearish pressure is weakening, and buyers may soon step in.

Practical Example

Let’s say you’re tracking crypto. The coin has been declining, but then you see the lows are converging upward.

Volume decreases as the pattern narrows, hinting that an upward breakout could be around the corner.

Why Takoz Reep Patterns Work: The Psychology Behind the Pattern

Technical analysis is about the psychology behind the gasses and also comes with the enslavement of individual capitalists in small units.

For instance, when takoz reep is mentioned, you should think that market tension is increasing.

The price keeps moving up and down at each try, but traders are still holding out in hope for a decisive turn one way or another.

Why Rising and Falling Wedges Work: Rising Wedge Often Shows Loss of Buying

Exhausted sellers are suggested by a fallen wedge.

Once the price breaks out of the pattern, it’s like a dam giving way- for the hypothetical purposes of this book, momentum usually barres in that direction.

Key Indicators to Use with Takoz Reep

Takoz reep doesn’t work in isolation. To maximize its effectiveness, use it with these indicators:

-

Volume

Volume is critical when identifying takoz reep patterns.

Look for declining volume as the pattern forms, and watch for a volume spike during the breakout.

-

Relative Strength Index (RSI)

The RSI helps you see if the asset is overbought or oversold, giving clues about the breakout direction.

-

Moving Averages

50-day and 200-day moving averages can act as support and resistance, helping you confirm breakouts.

Steps to Identify a Takoz Reep Pattern in Real-Time

Learning how to spot a takoz reep pattern in real-time can make all the difference in your trading.

Here’s a step-by-step guide to spotting it:

- Identify Trend – Look at the overall trend. Is it up or down?

- Check Highs and Lows – Spot converging highs and lows.

- Watch Volume – Volume should be lower as the pattern tightens.

- Wait for Breakout – Don’t jump in too early. Wait for a breakout confirmation.

- Set a Stop Loss – Place a stop loss just outside the wedge to manage risk.

Trading Strategy Using Takoz Reep

Now that you know how to spot takoz reep, let’s talk strategy.

Here’s how to structure a trade around a takoz reep pattern.

-

Entry Point

Enter the trade right after the breakout.

If you’re trading a rising wedge, look for a downward breakout to short.

For a falling wedge, buy after an upward breakout.

-

Stop Loss

Set a stop loss slightly outside the pattern’s boundary.

This protects you if the breakout is a fake-out.

-

Take Profit

Place your profit target based on the height of the wedge.

Measure from the start of the pattern and apply that range to your entry point.

Common Pitfalls to Avoid with Takoz Reep

No strategy is foolproof, and takoz reep is no different.

Here’s how to avoid common mistakes:

-

Ignoring Volume

Volume confirms the breakout. Without it, you’re risking a false signal.

-

Overtrading

Takoz Reep doesn’t show up every day. Don’t force trades when it’s not there.

-

Getting Emotional

Trading isn’t about excitement; it’s about discipline. Follow the pattern, not your gut.

Real-Life Example: Takoz Reep in Action

Let’s look at a real-life example to bring it all together.

Example: Apple Inc. (AAPL)

Imagine AAPL’s been on a steady uptrend, hitting new highs but with smaller price moves each time.

Suddenly, you spot a rising wedge pattern. Volume is decreasing, and RSI shows that the stock is overbought.

You wait for a breakout, and when it drops below the wedge, you short the stock.

Outcome?

With a stop loss just above the wedge, you manage your risk.

If AAPL drops, you’ve capitalized on a well-timed takoz reep pattern.

More info; traceloans-your-ultimate-guide

FAQs About Takoz Reep

-

Can I use Takoz Reep in short time frames?

Yes, Takoz Reep works in various time frames, but it’s more reliable in longer ones.

-

What’s the success rate for takoz reep?

The success rate depends on your execution and other market conditions.

It’s a high-probability pattern, but always combine it with other indicators.

-

How do I spot fake breakouts?

Volume helps. A true breakout usually comes with increased volume.

Advanced Takoz Reep Tips for Pro Traders

Ready to elevate your takoz reep strategy? Here are some advanced tips to help:

- Use Fibonacci Retracement: After a breakout, apply Fibonacci levels to identify potential retracement points.

- Apply Multiple Time Frames: Confirm the takoz reep pattern on a higher time frame to validate the trend direction.

- Combine with Support and Resistance: Look for takoz reep formations near key support or resistance levels to strengthen confirmation.

Top Tools for Trading Takoz Reep Patterns

Trading takoz reep patterns becomes much easier and more precise with the right tools. Whether you’re trading stocks, forex, or cryptocurrencies, reliable platforms can give you a significant advantage. Here are some of the best tools for identifying and trading takoz reep patterns:

- TradingView – Known for its powerful charting features, TradingView is excellent for spotting takoz reep patterns and analyzing market volume. Its user-friendly interface and wide range of custom indicators make it a favourite among traders. With the ability to track multiple assets, it’s ideal for multi-market analysis.

- MetaTrader 4/5 – Popular in forex trading, MetaTrader offers customizable indicators that can help you detect takoz reep patterns across various currency pairs. Its advanced analytics and back-testing options allow you to refine your strategy with historical data before committing to real funds.

- ThinkorSwim – A top choice for stock traders, ThinkorSwim includes built-in pattern recognition tools that simplify spotting takoz reep setups. This platform offers extensive market data, customizable charts, and a variety of indicators to help you perfect your strategy.

Conclusion

Takoz reep isn’t a magic formula, but it’s one of the most direct and reliable patterns for those looking to detect potential market reversals. By recognizing and combining takoz reep with powerful tools like volume analysis, the Relative Strength Index (RSI), and moving averages, you significantly boost your chances of identifying genuine market breakthroughs and minimizing false signals.

If you’re ready to start spotting takoz reep patterns and using them to your advantage, remember that patience and discipline are your best allies. The market can be unpredictable, but waiting for the right moment and sticking to a structured strategy often makes the difference. Whether you trade stocks, forex, or cryptocurrencies, takoz reep can be a highly effective addition to your approach—just remember to use it wisely, treating each setup as part of a broader plan rather than a shortcut.